How is Liquid Staking changing crypto and DeFi?

Exploring the Liquid Staking ecosystem, its challenges and the latest breakthroughs.

During the brutal market of 2022, only a handful of tokens finished the year on an up trend. One of those tokens was Lido’s stETH, the liquid staking derivative for Ethereum native token ETH, which has continued to gain market share. This continued strong growth is proof that liquid staking is gaining traction and has the potential to become the new normal for staking beyond the Ethereum ecosystem as well.

This article will explore the liquid staking ecosystem across several blockchain networks, the security and financial implications, and the cryptography advances in this industry.

Read what you need

But wait a second, what’s Liquid Staking?

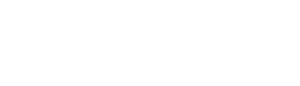

For starters, Proof of Stake (PoS) networks are secured by token holders who delegate or stake their tokens to validators, the actors in charge of validating blocks. The default design of PoS is not capital efficient since, in most cases, it takes several days, or even weeks, for a stakeholder to “unstake” to receive back the original assets if they want to sell or use it in DeFi.

This capital inefficiency has in some cases limited the security of PoS, meaning that it needs to compete with yields earned through DeFi. That’s where liquid staking comes into play since it offers token holders the possibility to earn staking rewards, secure the network and maintain a liquid position in DeFi – all at the same time!

Although each provider has unique characteristics, they have a similar way of operating. As a rule of thumb, when a stakeholder deposits his tokens to a liquid staking protocol, the latter generates a synthetic token representing the number of native tokens staked. Generally, these liquid staking tokens can be used in different DeFi primitives, including borrowing, lending, liquidity providing, etc.

New liquid staking protocols have also been developing additional functionalities. For example, Quicksilver, the Cosmos’ liquid staking zone, will allow users to choose validators and participate in the governance of the network.

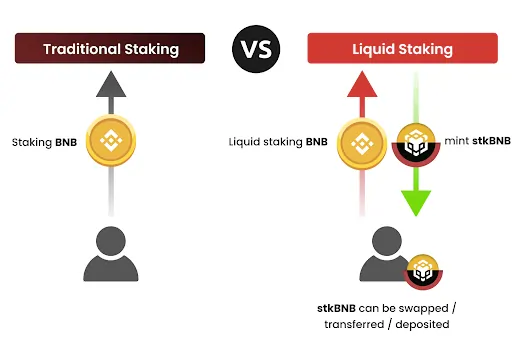

The industry is proliferating

According to DeFiLlama, the Liquid Staking market has a Total Value Locked of $9.2B, making it the third largest ecosystem in the DeFi sphere, just behind DEXes and lending protocols. But liquid staking has grown remarkably fast. For example, the liquid staking blue chip, Lido, launched only two years ago.

Out of the 62 active liquid staking protocols, 14 support Ethereum. Other significant ecosystems, such as Solana, have at most seven. Although most of the staked tokens are in protocols supporting multiple chains and ecosystems, during 2022, we saw a rise in the number of native liquid staking protocols going live. For example, Stride and Quicksilver were born in the Cosmos ecosystem as solutions targeting the interchain community. On Polkadot, at the same time, Acala, Bifrost and Parallel have developed solutions to liquid stake DOT.

In most PoS networks, excluding Ethereum, liquid staking still represents less than 10% of the staked tokens. Binance Smart Chain, with three protocols onboarded, has the highest share among these protocols (Excluding ETH), with 2.7% of liquid staked tokens compared with the $5.3B in traditional staking.

Everything comes with risk

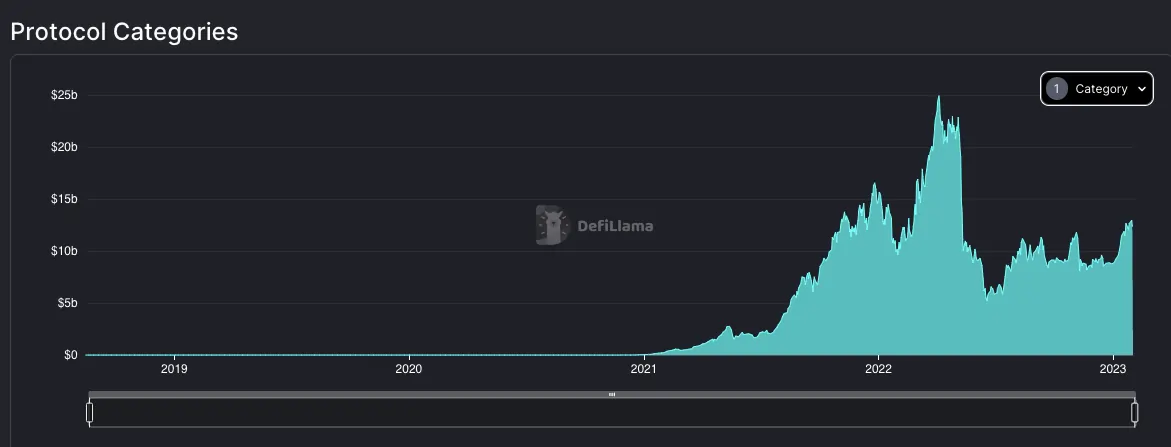

One of the main issues raised by the Ethereum community last year was the risk of centralisation due to the growing popularity of semi-centralised protocols such as Lido. The claim arises from the fact that these protocols concentrate a vast amount of power in just a few validators and governance token holders, which could make it possible for these protocols to have a significant influence over censorship and upgrades. In Ethereum alone, 45% of the staking power is in the hands of Lido and Kraken. If we look at other PoS protocols, that’s an exceptionally high concentration of stake.

Also, as seen during the Summer of 2022, there were some issues in the market, causing a depeg from liquid staking derivatives and the underlying asset.

As a response to these threats, some protocols have come to the table with exciting tech solutions that address centralisation concerns as we are going to show below.

The next wave of solutions is almost here

The centralisation issue

A few alternatives are coming to the market to address the issue of centralisation. Both Diva and Obol use Distributed Validator Technology (DVT). According to Obol’s blog, DVT is “a technology primitive that allows a single Ethereum validator to be split into multiple nodes that complete duties as a cluster. This builds in a level of fault tolerance—as long as a certain percentage of the nodes are active, the cluster as a whole will be active.”

In Cosmos, Quicksilver has a different approach to decentralisation. Instead of the protocol picking the validators that receive the stake, it’s the user who chooses the validator he feels comfortable with. Certain incentives built into the protocol also help reward users for choosing smaller validators.

We are proudly validating in Quicksilver and will be engaging with Diva to host validators on the Ethereum network.

Security enhanced

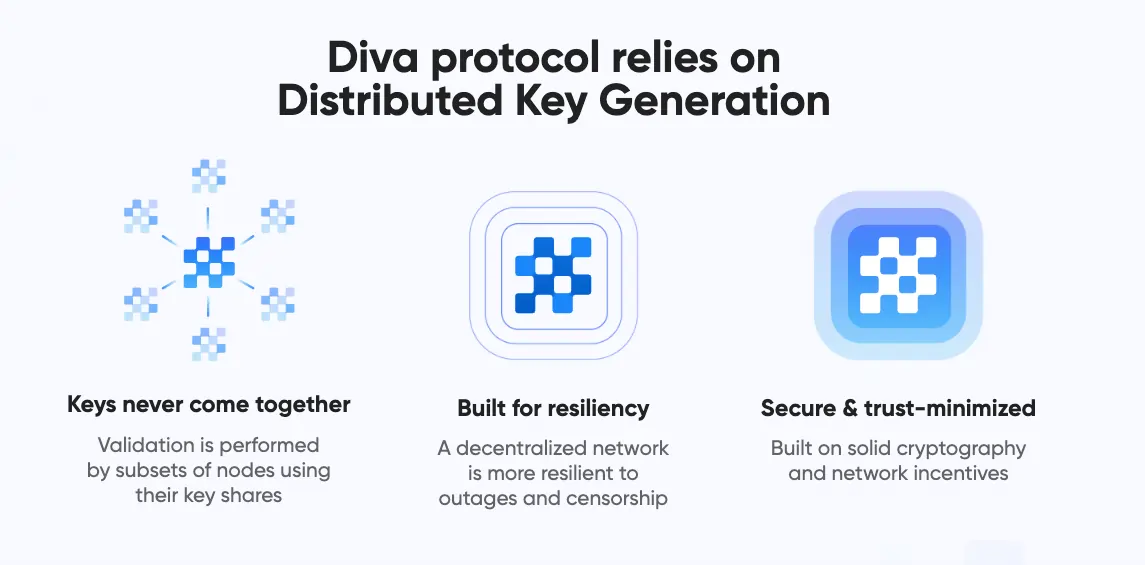

As liquid staking protocols become more decentralised, the infrastructure supporting these platforms require more security. Diva, for instance, will implement Distributed Key Generation (DKG), a method of securely generating a shared public and private key set without the need for Trusted Third Parties. In DKG, multiple parties contribute to calculating the key set, and the successful computation of the key pair depends on the participation of a minimum number of honest parties. This ensures that no single party has access to the private key and that the key generation process is secure against malicious contributions. DKG is often used for decrypting shared ciphertexts or creating digital group signatures.

User experience at the centre

The staking process may be one of the areas with the poorest UX across the blockchain industry. Many networks have needed to catch up to make this process easier. For example, until just a couple of months ago, the minimum amount of DOT to stake was 50 (around $200 at current prices), and users needed even more to qualify for staking rewards. Mina Protocol is another example of a relatively poor staking UX, making it difficult for non-technical users.

Due to the business model of liquid staking protocols, this UX problem is one of the most significant improvements they have made in contrast with vanilla staking. On Lido, it took three clicks to stake MATIC tokens. Not only will this improve the security of the networks, but it will also attract a new wave of retail users.

A validator's point of view

As a validator in many PoS networks, including Cosmos and Polkadot, liquid staking is an opportunity for these networks to become even more secure and, with the right technology, even more decentralised.

This technology will unlock many DeFi and governance use cases shortly, so we’re already validating in Quicksilver and exploring liquid staking protocols in other networks such as Ethereum.

Also, as privacy advocates, we see an opportunity to develop features that will preserve the identity of users through liquid staking derivatives. Moreover, there’s a lot of potential for using Zero Knowledge Proofs to enhance the security of liquid staking.

Conclusion

In less than two years, the liquid staking market has exploded in popularity, and the development in this area is just starting. We are excited to see how more liquid staking protocols evolve and introduce even more features that improve the user experience of staking.